Ah, the joys of homeownership – where unexpected roof disasters can turn our carefully crafted plans into a veritable storm of stress and uncertainty. But fret not, my fellow roof warriors, for I’m here to guide you through the murky waters of roof insurance claims and help you navigate the path to maximum compensation.

Understanding Your Roof Insurance Coverage

Let’s start with the basics – your homeowner’s insurance policy. It’s like a trusty sidekick, always there to lend a helping hand when Mother Nature decides to wreak havoc on your rooftop. But before you can call in the cavalry, you need to understand the fine print.

Every policy is unique, with its own quirks and peculiarities. Some may cover wind and hail damage, while others might exclude certain types of calamities. It’s important to review your policy thoroughly and familiarize yourself with the specifics. After all, you don’t want to be the one who discovers the hard way that your coverage doesn’t quite measure up.

According to the Texas Department of Insurance, a typical homeowner’s policy will cover roof repairs or replacement if the damage is caused by a covered peril, such as a severe storm, hail, or high winds. However, if the damage is due to wear and tear or lack of maintenance, your insurer may not be as generous.

Navigating the Insurance Claim Process

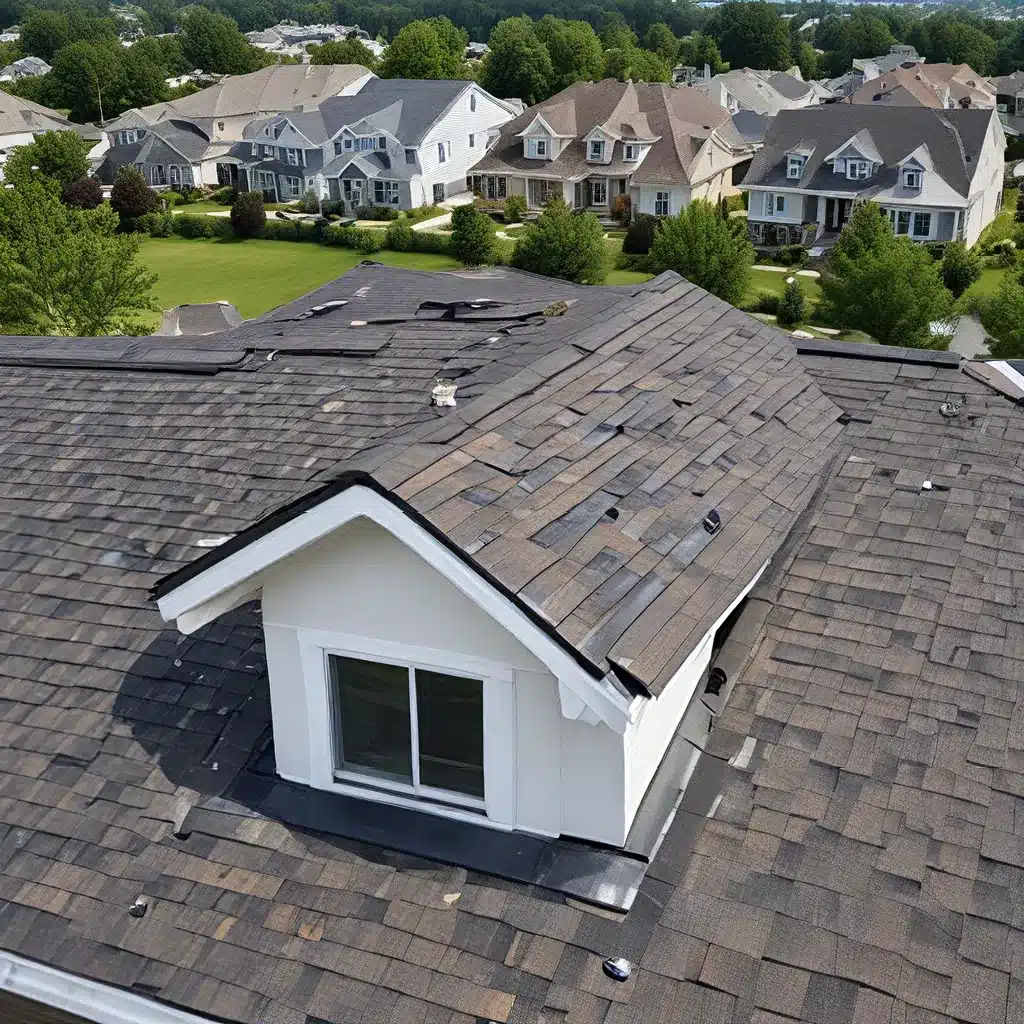

Now that you know what’s covered, it’s time to put on your detective hat and start gathering evidence. When you spot signs of roof damage, it’s crucial to document everything. Snap clear photographs from multiple angles, take detailed notes, and keep a meticulous record of every observation.

This comprehensive documentation will be your ace in the hole when it comes time to file that insurance claim. Remember, your insurance company is not a charity – they’ll be looking for any loophole to minimize their payouts. But with your well-organized evidence, you’ll be armed and ready to defend your case.

As the experts at Campo Roof advise, it’s also a good idea to establish a rapport with your insurance agent. They’re not the enemy – they’re your allies in this battle. By communicating openly and providing them with the necessary information, you’ll be more likely to get the maximum benefits for your roof repairs.

Selecting the Right Roofing Contractor

Now, let’s talk about the unsung heroes of the roofing world – the contractors. Choosing the right one can make all the difference between a smooth sailing insurance claim and a sinking ship.

Beware of the storm chasers – those shady characters who swoop in after a natural disaster, offering quick fixes and tempting deals. These are the snakes in the grass you want to steer clear of. Instead, focus on finding a reputable, licensed, and insured roofing contractor with a solid track record.

The team at Southern Roofing Company, for example, are experts in navigating the insurance claim process. They’ll work closely with your insurer, providing detailed estimates and documentation to ensure you receive the maximum coverage.

But the benefits of hiring a reliable contractor go beyond just the insurance claim. These professionals can also offer valuable strategic advice on maximizing your coverage, identifying potential upgrades or enhancements, and ensuring the longevity of your new roof.

Maximizing Your Roof Replacement Coverage

Ah, the holy grail – getting your insurance company to foot the entire bill for your roof replacement. It’s the dream, but it’s not always as straightforward as it seems.

As one homeowner on Reddit discovered, sometimes the insurance adjuster’s findings don’t quite align with the contractor’s estimates. This can lead to a coverage gap, where you’re left covering the difference out of your own pocket.

But fear not, there are ways to maximize your roof replacement coverage. By working closely with your contractor and providing detailed documentation, you can increase your chances of getting the full amount needed for a complete roof overhaul.

And don’t forget about those additional reimbursements – things like new gutters, damaged concrete, or fence repairs. Your contractor can help you navigate this process and ensure you’re getting every dollar you’re entitled to.

Maintaining Your Newly Replaced Roof

Ah, the sweet relief of a brand-new roof – it’s like a fresh start for your home. But don’t let your guard down just yet. Proper maintenance is the key to ensuring your newly installed roof stands the test of time.

Regular roof inspections are a must. Catching minor issues early can prevent them from turning into costly repairs down the line. And let’s not forget about keeping your roof clean – those pesky leaves, branches, and debris can wreak havoc if left unchecked.

Remember, a well-maintained roof is not only a matter of aesthetics – it’s a safeguard against future insurance claims. By taking proactive steps to preserve your new rooftop, you can save yourself time, money, and the headache of dealing with another round of calamity compensation.

So, there you have it, folks – your comprehensive guide to navigating the complexities of roof insurance claims and maximizing your coverage. Remember, knowledge is power, and with the right strategies in your toolkit, you can turn a roof calamity into a compensation bonanza. Happy roof hunting, my friends!